Q. What is PAN?

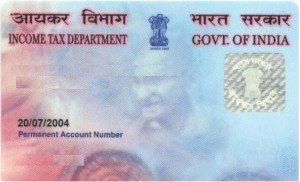

Ans. PAN, is an acronym for Permanent Account Number. It is a ten-digit alphanumeric code that is required by all those involved in any financial deal, be it payment of tax or investing in the Share Market. It is issued by the Income Tax (I-T) Department of the Government of India in the form of a laminated card. A typical PAN would read like ABCD84521K. (In nutshell it can be also called as an Indian Number for Taxation purposes).

Q. Why is it necessary to have PAN?

Ans. As per the revised rules of the I-T Department, it is compulsory to have PAN if you are involved in any kind of monetary transaction whatsoever. Such deals may include payment of tax, buying or selling of automobiles, depositing cash more than Rs. 50000 in bank, paying bills worth more than Rs. 25000 in hotels, obtaining a new telephone connection, investing in the Indian Share Market etc. Moreover, PAN serves as an identity proof.

Q. What is the procedure for getting PAN made? OR how can I apply for PAN?

Ans. IT Department has set up numerable facilitation centres from where one can buy/submit Form 49A. These facilitation centres are supervised by UTIISL or NSDL and have been authorised to mete out PAN services from TIN facilitation centres.

Incomplete forms will NOT be accepted.

Q. What are the documents required to be submitted along with the application form?

Ans. In case of individual applicants:

There are different documents needed for Individual, HUF, PIOs, and NRIs. In general documents needed are:

- Bank Statement,

- OCI/PIO Card copy,

- Foreign/Indian passport, etc.

- PhotoGraph

Exact documents would vary from case to case. So please email us to inquire about the supporting documents needed before you send out the application to us. ( Email us )

Note: Photograph is compulsory ONLY in case of individual applicants.

Q. Can a person obtain more than one PAN?

Ans. Having more than one PAN is a punishable offence. However you can apply for a new or duplicate pan card just in case you have lost your old pan card. This new pan card would bear the same old permanent account number.

Q. How to locate the nearest I-T facilitation centre?

Ans. The local I-T Office, and/or any office of the UTI/UTIISL/NSDL, and/or any of the following website : www.incometaxindia.gov.in, www.utiisl.com, tin.nsdl.com – can help you locate the nearest I-T facilitation centre.

Q. Are there any documents to be submitted with the Request form?

Ans. Yes. While submitting your Request for New Card and/or Change in PAN Data, you have to submit the following:

- Proof of PAN (either copy of PAN Card or copy of PAN allotment number)

- Proof of PAN(s) surrendered (either copy of PAN Card or copy of PAN allotment number)

- Proof of identity (same as mentioned above depending on your status)

- Proof of address (same as mentioned above depending on your status)

- Proof in support of changes sought, if any

Q. What is to be done if we have not received the PAN but have applied for the same some time back? OR I have to file tax returns but I have not obtained my PAN despite having submitted my application a month back.

Ans. For such cases, please contact Aaykar Sampark Kendra (ASK) at 0124 – 2438 000 , or visit www.incometaxindia.gov.in and go to now your PAN .

Q. Do you have to apply for PAN again in case of change of residence?

Ans. PAN is a permanent number and remains the same lifelong. You do not have to apply for a new PAN in case of change of residence (even if the change pertains to change in city). But such changes have to be brought to the notice of the I-T Department so that they may update their data. For this you will have to fill out Request for New Card and/or Change in PAN Data’s.

Q. How can i verify my PAN details?

Ans. You can verify PAn details by visiting income tax department website.Step by step guide on how to verify PAN is given here

IMPORTANT POINTERS for Applying PAN:

In case of an illiterate, left hand thumb impression should be affixed in place meant for signature in the respective form and get the same attested by a Magistrate or Notary Public or Gazetted Officer

In case of female applicants, irrespective of marital status, father’s name HAS to be mentioned.

Providing one’s contact number is not compulsory, but it is advised to do so for quick communication.

A Representative Assessee may apply for PAN in case of non-resident, minor, lunatic, idiot and court of wards.

The I-T Department henceforth will issue new tamper proof PAN cards. While the existing PAN Cards are valid, you may apply for a new one after surrendering your old one.

If you have received your PAN but not your Card, apply in the ‘Request for New Card and/or Change in PAN Data’ form quoting your PAN.

my pan no is ACPPJ5674G and return file was made in the month of july2013 for the assesment year of 2013-14. when should i get my refund?

sir still i have not received my incomtax refund of 2013-2014 please take necessary action,AEVPM0624H