Self Assessment Tax is balance of income tax that is required to be paid on total assessed income after adjusting Advance Tax and TDS ( tax Deducted at source).

What is Difference between TDS and Self Assessment Tax

TDS is Tax Deducted at Source, by person ( for example- employer, contract payment and professional payments).

In case of employees, TDS is deducted monthly by employer and deposited with IT department.

Where as Self Assessment Tax, as name suggests, is payment made by income tax assessee after determining balance tax payable.

Lets take a example :

- A person is required to pay total income tax of Rs 2,00,000 (2 lacs) .

- His TDS deducted by employer, or Bank etc is Rs 1.8 lacs,

- Then balance of Rs 20, 000/- . He should be paying this tax before filing income tax return. This remainig tax is called as Self Assessment Tax.

How to pay Self Assessment Tax.

There are two ways of paying self assessment tax-

- Making payment offline for Self Assessment Tax. The process of offline tax payment involves

- Filing up the income tax Challan 280,

- Attaching the cheque along with Challan for depositing Tax ,

- Deposting with bank and

- Dollecting the receipt of the challan.

- You can download Tax Deposit challan from here – Challan 280 and Challan 281

- Online payment of Self Assessment Tax:

Best way to pay self assessment tax is making payment online. This is most simple and efficient way of paying income Tax.

Steps to make online payment of Self Assessment Tax is given below:

Step 1 for depositing Self Assessment Tax :

Visit Site: https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp to pay your Self Assessment Tax

Step 2 Select Challan 280 / ITNS 280:

Step 3 Select (oo21) Income Tax ( OTHER THAN COMPANIES):

Step 3 a Enter your PAN no

Step 3 b Enter Correct assessment year

- If you are paying income tax for Year April 2013 to March 2014 then Assessment year is 2014-2015

- If you are paying income tax for Year April 2014 to March 2015 then Assessment year is 2015-2016

- If you are paying income tax for Year April 2015 to March 2016 then Assessment year is 2016-2017

Step 3 c Enter your Address and email address

Step 3 d Type of payment

Please select option (300) SELF ASSESSMENT TAX

if you are paying advance tax then please option (100) ADVANCE TAX

Step 3 E Select the bank from which you will making payment

Please note that it is important that your online net banking userd id and pasword is active for making payment online.

Step 3 F Enter the captcha code that is visible

Step 4 After submitting the page you will be taken to confirmation page for self assessment tax

Step 5 After reviewing your details click on proceed.

Step 5 This will take you to your bank page.

Step 6 Enter you user id and password

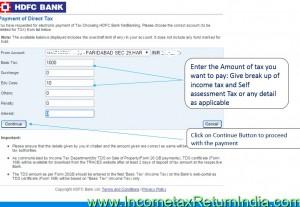

Step 7 Enter the break up of Income tax , Surcharge , Education cess and penalty

Step 6 On Submission, CIN ( Challan Identification number will be generated) keep copy of this challan number

CIN number is very important. Save it, take a printout and file this CIN number. This CIN number will be used in efiling income tax return.

Like this Guide on making Self Assessment Tax, Share with your friends, Follow us on Facebook and Google Plus. Subscribe us on on You tube and watch more ” How to pay Self Assessment Tax online Video “

Still having doubts, we can assist you in filing income tax return. Start filing your income Tax return. Need help in filing tax return.